For Real Estate Investors, Business Owners, Freelancers & Content Creators Ready to 10x their investments...

The Exact Legal & Ethical Strategies I Use to Pay $0 in Taxes Every Year - And How You Can Use Them to Save $10K+ This Year

Learn The Exact Strategies That Helped My Students Save Over $80 Million In Taxes

Secure Payment

All orders are through a very secure network. Your credit card information is never stored in any way. We respect your privacy.

Business Owners Like You Are Overpaying Taxes By $20K–$100K+ Every Year...

The Worst Part?

You're Following All The Rules — Just Not The RIGHT Rules.

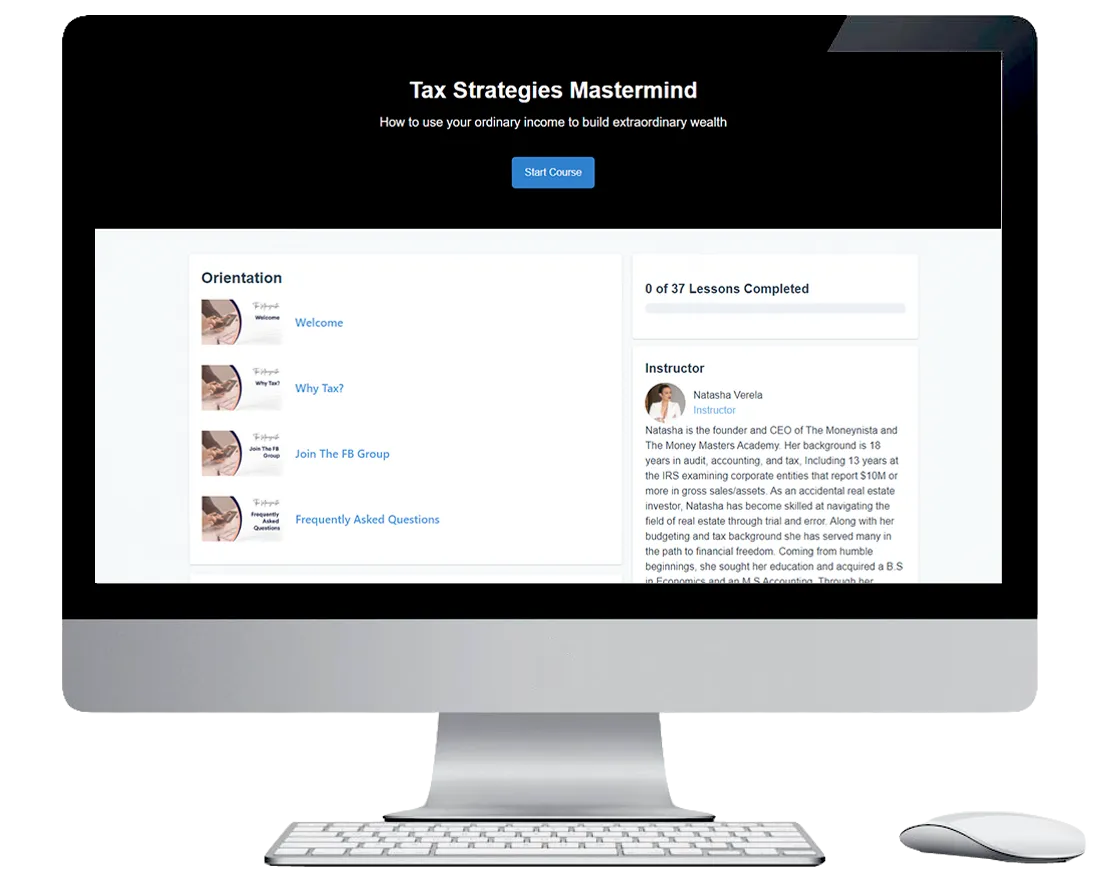

In Tax Strategies Mastermind, I'll Reveal The Legal Strategies I Learned During My 13 Years Inside The IRS...

The Same Strategies That Have Saved My Students Millions In Taxes

What's In The Course

STOP Choosing the Wrong Business Structure! - Discover Which of the 4 Entity Types Will Save You $10K+ Per Year (Most People Pick the Most Expensive One)

The IRC Section 162 "Hidden Deduction Vault" - Unlock Travel, Meals, Entertainment & Vehicle Write-Offs Your Competitors Are Missing

The "Reasonable Compensation Loophole" - Legally Slash Your Self-Employment Tax by Thousands (Your CPA Probably Calculates This Wrong)

Turn Your Home Into a Tax-Saving Machine - The Business Use of Home Strategy That Works Even if You Rent (Most People Leave This Money on the Table)

Real Estate Professional Status (REPS) - The "Golden Ticket" That Can Save You $50K+ Annually (Even if You Have a Day Job)

Cost Segregation Bonus Depreciation - Write Off Your ENTIRE Property in Year One Instead of Waiting 27.5 Years

Put Your Kids on Payroll Legally - Shift Income to Lower Tax Brackets While Teaching Them About Money (Genius Strategy!)

Retirement Planning That Actually Works - Build Massive Tax-Deferred Wealth While Others Struggle With 401Ks

24/7 AI Tax Assistant Access - Get Instant Answers to Your Tax Questions Anytime, Anywhere (Like Having a Personal Tax Expert in Your Pocket!)

🎁 BONUS TRAINING: Breaking Down Personal Credit

VALUE STACK: TOTAL VALUE = $15,000

🔥 LIMITED TIME OFFER! BUY NOW AND GET INSTANT ACCESS TO:

✅ Complete Tax Strategies Mastermind Program ✅ 24/7 AI Tax Assistant Access ✅ All Implementation Tools & Resources

AND GET UP TO 85% OFF TODAY!

TOTAL PRICE = $15,000 $2,399

MEET YOUR INSTRUCTOR:

Natasha Verela

Tax Strategist

Author of Beyond Money

Enrolled Agent

Former IRS Agent

Real Estate Investor

Business Owner

STUDENT SUCCESS STORIES...

"I learned so much about how to move within the tax code and build wealth"

Andrea Clark, Social Selling Coach

"Through the academy, we learned how to lower our tax liability"

Jasmine & Darryl Brooks, Brooks Home Designs

"Going through the Moneynista Program gave us the knowledge to do it ourselves"

Yvonne & Peter Ebanks, Real Estate Professional

"I was able to recapture over $40,000 that I'll be able to reinvest to real estate"

Tim Barnett, Real Estate Professional

The Complete Tax Mastery Curriculum

Setting Your Foundation: Business Activities

Establish your operations so the IRS can't classify your business as a "hobby" - this foundational step protects all your future deductions.

Setting Your Foundation: Business Structure

Choose the right entity structure (LLC, S-Corp, etc.) that minimizes your tax burden based on your specific situation.

Business Deductions (IRC Section 162)

Master every legal business deduction including vehicle expenses, travel, meals, entertainment, and home office strategies.

Tax Avoidance: Real Estate

Advanced real estate strategies including depreciation, cost segregation, and Real Estate Professional Status (REPS) that can save $50K+ annually.

Tax Deferral Strategies

Legal methods to defer taxes and build long-term wealth through strategic retirement planning and advanced structures.

Planning & Execution

Implementation strategies, TurboTax guidance, Multi-Member LLC setup, and estate planning to put everything into action.

BONUS: 24/7 AI Tax Assistant Access

Get Instant Answers to Your Tax Questions Anytime, Anywhere (Like Having a Personal Tax Expert in Your Pocket!)

FAQs

When does the course start and finish?

The course starts now and never ends! It is a completely self-paced online course - you decide when you start and when you finish.

How long do I have access to the course?

Lifetime access sound good? After enrolling, you have unlimited access to this course for as long as you like - across any and all devices you own.

What if I am unhappy with the course?

There are no refunds for this program. You will have access to the instructor to answer your questions and concerns via a dedicated email and access to a private Facebook community for help.

I do not wish to sell you a service but to educate you lifelong. When you file your taxes you are already buying the tax code. I am in the business of educating and providing real life guidance to help you understand how true wealth building works with effective and legal tax strategies.