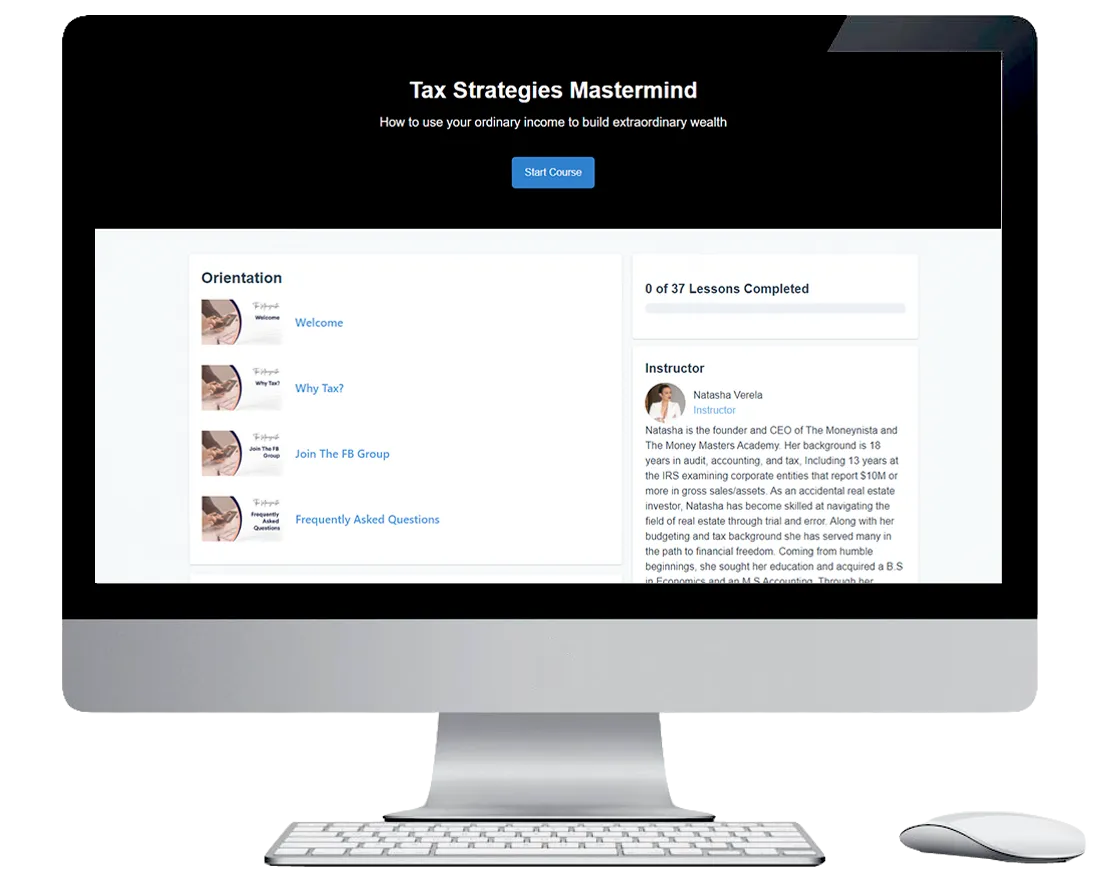

The Money Masters Academy - Tax Strategies Mastermind

Course + Coaching + Community

Former IRS Employee Reveals How The US Tax Code Allows Everyday Citizens To Legally Avoid Tax…

For Start ups, Freelancers , Business Owner, and Real Estate Investors

Step1Please Tell Us Where To Send Access

Step2Complete Your Order

Secure Payment

All orders are through a very secure network. Your credit card information is never stored in any way. We respect your privacy.

What's In The Course

Tax Strategies

- Learn beneficial tax-saving strategies and income shifting techniques with legal tax deferral and avoidance strategies.

- Learn to take advantage of your 401K and other retirement planning.

- Shelter your income and generate cash flow in the Real Estate business.

Increase your business's bottom line with high impact tax strategies

- Learn to run YOUR OWN NUMBERS to manage your liability all year round in real time.

TOTAL VALUE = $15,000

LIMITED TIME OFFER! BUY NOW AND GET INSTANT ACCESS TO:

BONUS TRAINING: Breaking Down Personal Credit

AND GET UP TO 85% OFF TODAY!

TOTAL PRICE = $15,000 $2,399

Business Structure

- Gain an understanding of partnership breakdowns (LLC, Partnerships, S Corporations, & Sole proprietorships).

- Learn the effects tax has on each and choose the best one for you.

- Get a walk-through of IRS allowed deductions.

- Employ proper book-keeping and documentation methods.

- Learn audit prevention procedures to avoid IRS.

Continuous Support

- Continue learning with additional teaching material, ongoing check-ups, and a private community support group.

- Solid resources used for documentation

- Continuous Support from your mentor & instructor tax professional, Natasha Verela.

- Dedicated email for Q&As that address YOUR questions.

- Private Facebook group with community support and valuable insights from your peers.

Add-Ons

- Protect yourself as an investor with Renter Guarantor Insurance

- Solidify yourself as a Real Estate Investor with professional status Via IRS Standards to offset ALL income.

STUDENT SUCCESS STORIES...

"I learned so much about how to move within the tax code and build wealth"

Andrea Clark, Social Selling Coach

"Through the academy, we learned how to lower our tax liability"

Jasmine & Darryl Brooks, Brooks Home Designs

"Going through the Moneynista Program gave us the knowledge to do it ourselves"

Yvonne & Peter Ebanks, Real Estate Professional

"I was able to recapture over $40,000 that I'll be able to reinvest to real estate"

Tim Barnett, Real Estate Professional

Start Keeping More Of Your Money Throughout The Year!

FAQs

When does the course start and finish?

The course starts now and never ends! It is a completely self-paced online course - you decide when you start and when you finish.

How long do I have access to the course?

Lifetime access sound good? After enrolling, you have unlimited access to this course for as long as you like - across any and all devices you own.

What if I am unhappy with the course?

There are no refunds for this program. You will have access to the instructor to answer your questions and concerns via a dedicated email and access to a private Facebook community for help.