Need Help? Email Me HERE

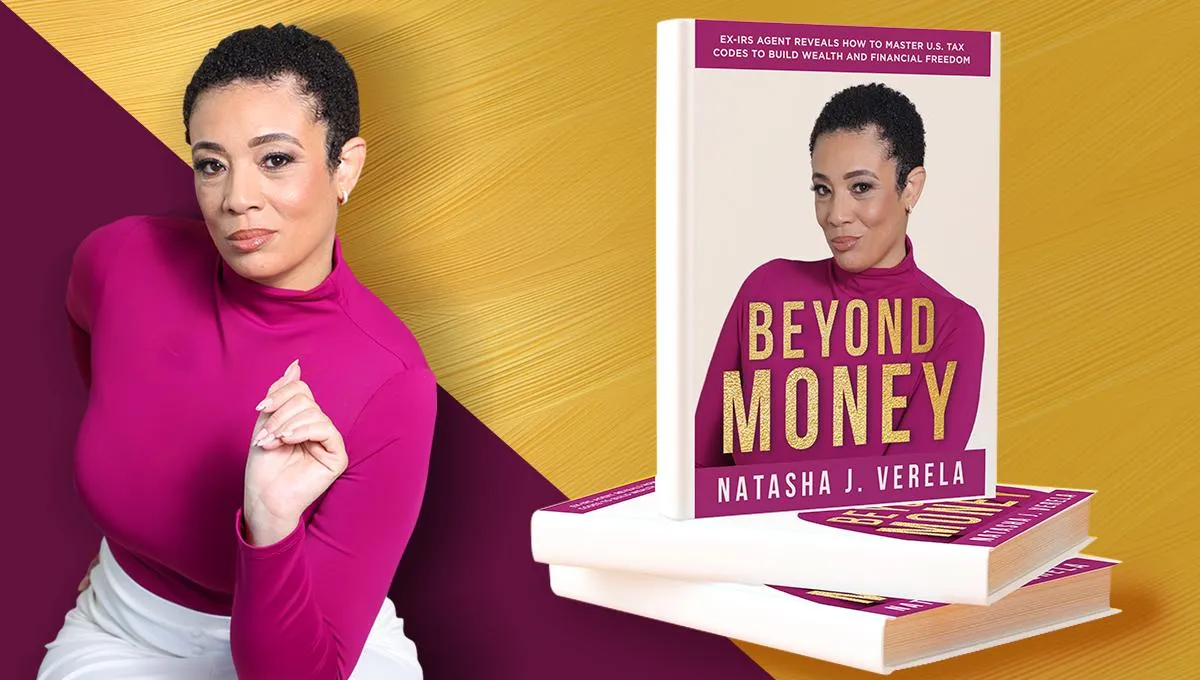

Former IRS Agent And Renowned Tax Expert Reveals:

The Step-By-Step Guide To Legally Avoid Most of Your Taxes and Build Wealth In

One Eye-Opening Book

So you can grow your income, build wealth, and save more while sharing less with the government

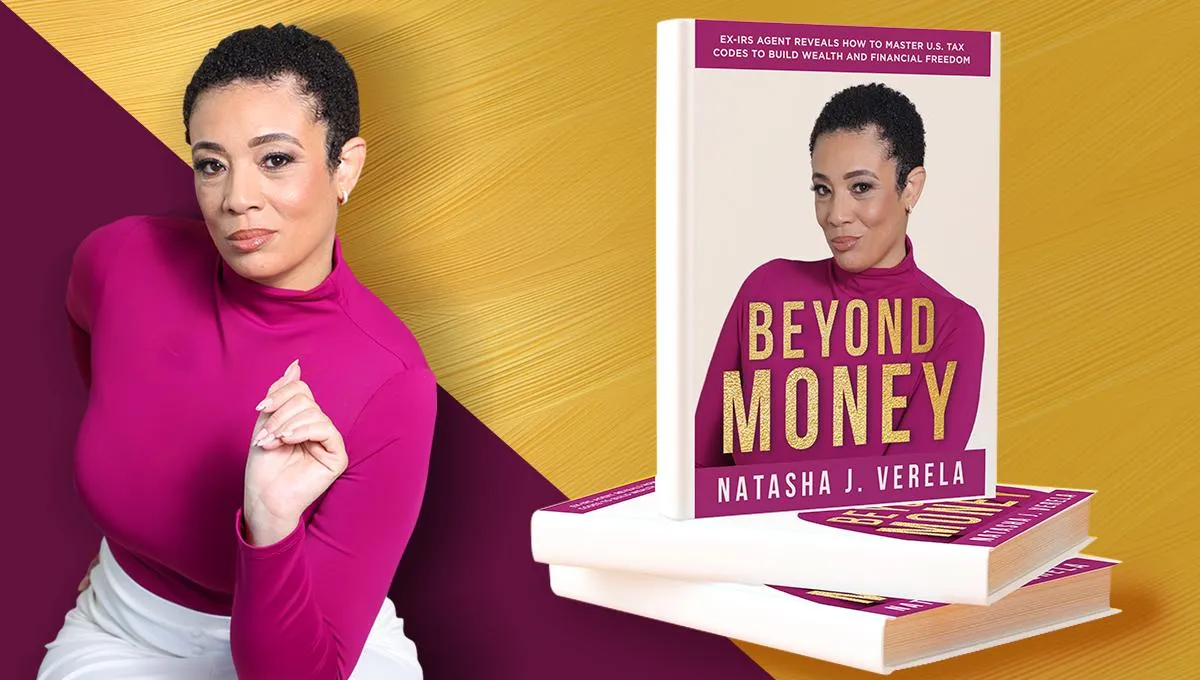

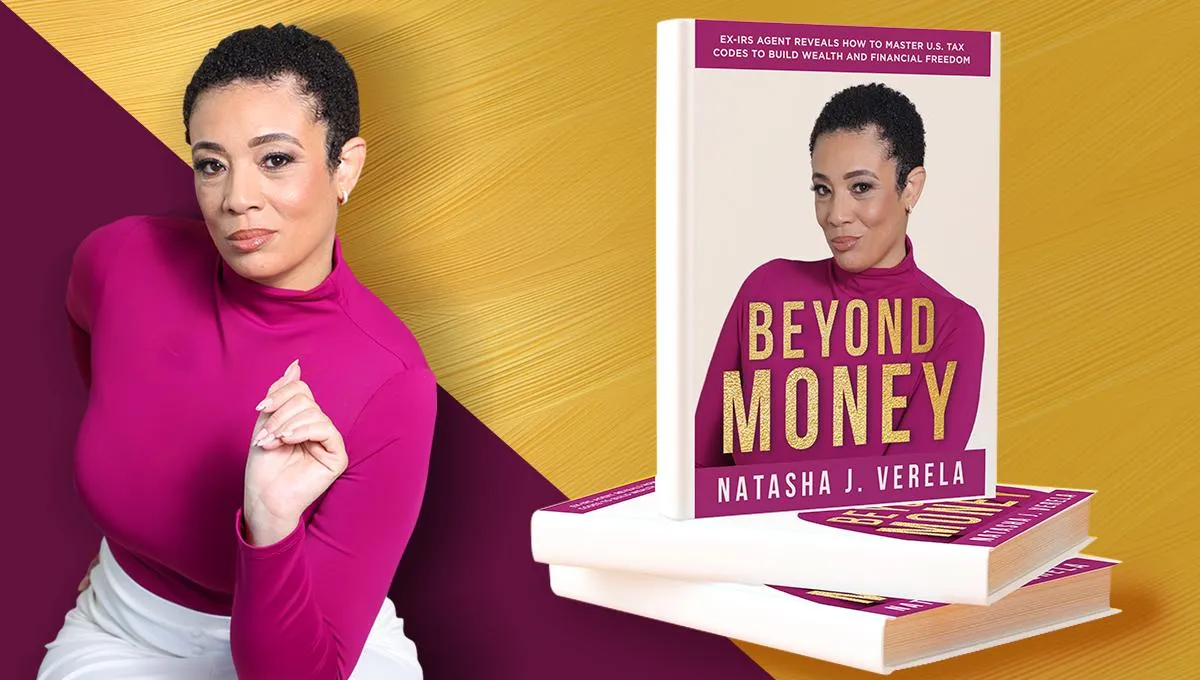

What Is Beyond Money?

Beyond Money is your comprehensive guide to transforming your financial future. It reveals how you can take control of your finances, avoid overpaying taxes, and build the wealth that's within your reach.

Natasha Verela, a former IRS agent, breaks down the exact strategies she used to go from being an employee to a financially free real estate investor—strategies that have also helped countless others stop living paycheck to paycheck.

In this book, Natasha has compiled everything she learned so you can avoid the same costly mistakes that prevent so many people from unlocking their full financial potential.

With Beyond Money, you'll be empowered to take the first steps toward achieving true wealth and financial freedom. This is what Beyond Money is all about—giving you the knowledge to create a financially secure and prosperous life.

Limited Time Offer!

Only $29.99 Today

Get instant access to the digital copy today for $29.99! Start consuming it in the next 5 minutes.

Now Available For Instant Access

100% Secure 256-Bit Encrypted Checkout

Backed by Our 100% Money Back Guarantee.

Beyond Money Is A Shortcut

I still remember waking up every day feeling completely drained, wondering how I was going to pay the bills, keep up with my job, and just make it through the week.

I had a steady job at the IRS, but all I could think about was how the wealthy seemed to have it all figured out while I was stuck, paycheck to paycheck.

This was during the 2008 recession, and while I was thankful to still have a job, I couldn’t shake the feeling that I was trapped. Trapped in a cycle of going to work, watching most of my paycheck disappear to student loans and my mortgage, while the rich kept getting richer.

It felt like they knew something I didn’t.

So I made it my mission to figure it out. I dove into the tax code, determined to understand how they were using it to their advantage. It wasn’t easy. I made mistakes, took risks, and learned the hard way. But eventually, things started to click.

The wealthiest people are rich because they were using the tax code in ways I had never even thought of—primarily through real estate.

Every tax return I analyzed seemed to tell the same story. Real estate wasn’t just another investment; it was a tool to build wealth while slashing taxes.

I realized that real estate wasn’t just about collecting rent; it was about using strategic deductions, depreciation, and other tax benefits to significantly reduce how much I was giving to the IRS each year.

And that’s when I made the decision that changed everything.

In 2013, I bought my first rental property. That was the turning point. I used the tax strategies I’d spent years learning to keep more of my income and start investing in something that would grow. Within a few years, I was able to quit my job.

By 2023, I was making six figures in passive income, and for the first time in my life, I wasn’t worried about money. I had freedom.

That’s why I wrote Beyond Money.

This book is your shortcut. It’s everything I wish I knew when I was struggling, laid out step by step, so you don’t have to go through the same trial and error that I did.

I’ve done the hard work. I’ve made the mistakes. Now, you can use what I’ve learned to take control of your finances, stop overpaying on taxes, and start building real wealth.

This isn’t just about money. It’s about freedom. The freedom to live your life without constantly stressing about your next paycheck.

Beyond Money is here to show you how to make that happen.

Here’s Everything You’ll Get By Getting A Copy Of Beyond Money Book Today For Just $29.99!

Chapter 1 – My Story

Natasha shares her personal journey of financial struggle and how she broke free from the constraints of traditional income sources to pursue financial freedom through tax strategies and real estate investing.

Chapter 2 – Never Leave Ordinary Income on the Table

Discusses the importance of maximizing ordinary income and how to reduce tax liabilities through effective planning, ensuring no money is unnecessarily left for the IRS.

Chapter 3 – The Four Tax Codes You Need to Succeed

Introduces four critical tax codes that are essential for wealth building. These codes are designed to help business owners and real estate investors legally avoid overpaying taxes.

Chapter 4 – Business Structure

Explains the various business structures (Sole Proprietorship, LLC, S Corporation, C Corporation) and their implications for tax liability. Natasha advises on choosing the right structure to optimize for tax savings.

Chapter 5 – Business Ownership & Strategy

Outlines strategies for business owners to maximize tax benefits and minimize liabilities. This chapter covers key tactics like deductions, hiring family members, and the power of depreciation.

Chapter 6 – Real Estate Investment and Strategy

Focuses on the unique tax advantages available to real estate investors, such as depreciation, bonus depreciation, and deductions for rental properties. This chapter also explores the long-term benefits of real estate investing.

Chapter 7 – How to Maximize Your Tax Saving While Building Wealth

Provides actionable advice on leveraging tax-saving strategies while growing wealth. Emphasizes high-impact deductions and maximizing tax advantages through smart investing.

Chapter 8 – The Ideal Marriage

Discusses the benefits of marrying real estate and business ownership as complementary strategies for financial growth. It highlights how combining these can lead to substantial tax savings and wealth accumulation.

From IRS Employee to Making Six Figures in Passive Income Working Just a Few Hours a Day—All While Slashing My Tax Bill!

I have created a book that is completely unlike anything you’ve ever read before - read the story below

Dear Future Millionaire

From: Natasha Verela

Re: Save On Taxes and Keep More Of What You Earn From Investments (To Build True Wealth)

Would it surprise you to know that I became financially free by applying the exact strategies I reveal in Beyond Money?

Skeptical?

You should be. After all, you can’t believe everything you see online.

So let me break it down for you

But first, a quick disclaimer:

I spent years working at the IRS, surrounded by high-level real estate investors who showed me how they used the tax code to build wealth. But the average person who buys any “how-to” guide often struggles to see the same results. I’m sharing these strategies as examples, not guarantees.

Your results will vary based on your experience, work ethic, and willingness to act. Building wealth doesn’t happen overnight—it’s about doing the work and staying consistent. If you’re not ready to put in the effort, Beyond Money isn’t for you.

It took me years of trial and error to create the system I use now. And while this book will help you avoid the same mistakes I made, you’ll still need to roll up your sleeves and implement the strategies.

That said…

I promise you, it’s not complicated to start saving tens of thousands on taxes and building real wealth with the strategies you’ll discover in Beyond Money…

Because Beyond Money is being used by people all across the country to completely transform their financial futures by leveraging the tax code and smart investing…

...And in turn, they’re keeping more of their income, growing their wealth, and paying far less in taxes each year…

...All while gaining more time and freedom to focus on what really matters to them.

Best of all, they’re finally living the life they deserve—with financial stability and the knowledge to keep growing their wealth.

Just Like Tim, Who Implemented The Strategies Found In The Book Has This To Say…

And even though Tim was able to save tens of thousands in taxes, that's not even the best part…

The best part is that he was able to invest that money into a new income-generating property…that he wouldn’t have been able to buy in time if it wasn’t for his tax savings.

The strategies found in Beyond Money also showed him how to use the tax code and smart investing strategies to save thousands, pay off his debt, and build real wealth.

As a result, he wasn’t just earning money anymore—he was making his money work for him, all while paying less in taxes and gaining the freedom to spend more time with her family.

And he’s not the only one…

Hear from some of my students…

Jasmine And Daryl Brooks

Real Estate Investors

Yvone And Peter Ebanks

Real Estate Investors

Get A Copy Of Beyond Money Book Today For Just $29.99!

Limited Time Offer!

$29.99

Get instant access to the digital copy today for $29.99! Start consuming it in the next 5 minutes.

Available For Instant Access

So will you take action today to do something that could potentially change your life…

For only $29.99?

That’s less than the price of two Big Macs.

If your answer is “Yes”, then go ahead and click that button above!

To your success,

Natasha Verela

Get Instant Access

$29.99

($200 Save $170.00 today)

Download The eBook For Just $29.99! Delivered instantly. Start reading in the next 2 minutes.

Available For Instant Access

Frequently Asked Questions

Do I Get Lifetime Access To The Book?

Yes! You get lifetime access to the digital copy.

What If I Have More Questions?

Feel Free To Message Me In My Support Email

Here’s Everything You’ll Get By Getting A Copy Of Beyond Money Book Today For Just $29.99!

CHAPTER 1

My Story

Natasha shares her personal journey of financial struggle and how she broke free from the constraints of traditional income sources to pursue financial freedom through tax strategies and real estate investing.

CHAPTER 2

Never Leave Ordinary Income on the Table

Discusses the importance of maximizing ordinary income and how to reduce tax liabilities through effective planning, ensuring no money is unnecessarily left for the IRS.

CHAPTER 3

The Four Tax Codes You Need to Succeed

Introduces four critical tax codes that are essential for wealth building. These codes are designed to help business owners and real estate investors legally avoid overpaying taxes.

CHAPTER 4

Business Structure

Explains the various business structures (Sole Proprietorship, LLC, S Corporation, C Corporation) and their implications for tax liability. Natasha advises on choosing the right structure to optimize for tax savings.

CHAPTER 5

Business Ownership & Strategy

Outlines strategies for business owners to maximize tax benefits and minimize liabilities. This chapter covers key tactics like deductions, hiring family members, and the power of depreciation.

CHAPTER 6

Real Estate Investment and Strategy

Focuses on the unique tax advantages available to real estate investors, such as depreciation, bonus depreciation, and deductions for rental properties. This chapter also explores the long-term benefits of real estate investing.

CHAPTER 7

How to Maximize Your Tax Saving While Building Wealth

Provides actionable advice on leveraging tax-saving strategies while growing wealth. Emphasizes high-impact deductions and maximizing tax advantages through smart investing.

CHAPTER 8

The Ideal Marriage

Discusses the benefits of marrying real estate and business ownership as complementary strategies for financial growth. It highlights how combining these can lead to substantial tax savings and wealth accumulation.

While Beyond Money Costs $29.99, The Cost Of Not Saving On Your Taxes Is Far More Expensive

You might be looking at this page and wondering if Beyond Money is worth the investment.

But here’s the thing—this kind of thinking only considers the cost of taking action.

What about the cost of not taking action?

Right now, the U.S. government is taking a huge chunk of your income. If you’re making $40K to $85K, you’re taxed at 22%. If you’re earning over $170K, that rate jumps to 32%. And the higher you go, the more you’re handing over to the IRS. Every year, you're losing thousands of dollars to taxes, money that could be working for you instead of disappearing into Uncle Sam’s pockets.

Not to mention, your salary loses value over time. With inflation, your paycheck is worth 4-10% less each year, meaning you’re effectively getting a pay cut every year. You work hard, but you’re not moving forward—you're stuck in the same place, just working to stay afloat.

Without taking action, you’re risking more than just your paycheck. You’re delaying your retirement, carrying financial stress into your later years, and missing the chance to build generational wealth for your family.

But what if you took a different path?

If you read Beyond Money and apply just one tax-saving strategy, you could start saving thousands in taxes each year. Imagine saving an extra $1K per month—$12K a year back in your pocket. Now, take that knowledge further, invest it, or start a side hustle. Let’s say that brings in another $5K a month—$60K a year.

It’s not just possible, it’s realistic.

The beauty of the strategies in Beyond Money is that they work whether you’re a stay-at-home parent, a corporate employee, or a high-income earner. They’re designed to save you money, grow your wealth, and keep more of what you earn.

So, don’t think of this book as a cost—it’s an investment in your future.

Take one step today that your future self will thank you for.

I’m so confident in these strategies that I guarantee you’ll see results within 30 days. If you don’t save more than the price of this book in that time, I’ll refund your $29.99, no questions asked.

Frequently Asked Questions

Do I Get Lifetime Access To The Book?

Yes! You get lifetime access to the digital copy.

What If I Have More Questions?

Feel Free To Message Me In My Support Email